We have closely collaborated with the ACLU in defense of Native civil liberties (see here and here) and even advertised ourselves as proud partners of the ACLU. So our disappointment with the ACLU's decision to file a friend-of-the-court brief in support of Dan Synder's R*****ns trademark runs deep. The ACLU is the most valiant and effective defender of the First Amendment; we are grateful. They are so formidable that the mere filing of the ACLU's amicus brief could foretell victory in U.S. District Court for Dan Snyder.

Beyond that fear, there are primarily two troubling things about the ACLU's support of the R*****ns trademark.

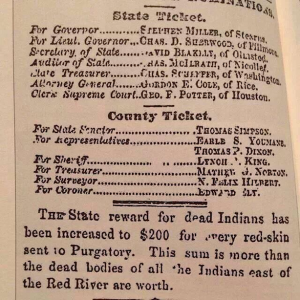

First, the ACLU downplays the impact of the R word by merely describing it as "outdated, racist language." But they fail to appreciate that the word is not just racist--it connotes genocide, defined as:

synonyms: mass murder, mass homicide, massacre; annihilation, extermination, elimination, liquidation, eradication,decimation, butchery, bloodletting; pogrom, ethnic cleansing, holocaust

Consider:

Indeed, it is intellectually dishonest to simply dub the R word "racist." The First Amendment, at least via trademark protection, must not protect the rhetoric of genocide. Such language, especially when used by a for-profit NFL football franchise, is in fact "immoral" as contemplated by Section 2(a) of the Lanham Act.

The ACLU cites disputes over trademarks protection for the words "the Slants" and "Dykes on Bikes," arguing that "the reappropriation of terms that have historically disparaged marginalized groups is a common way for those same groups to reclaim the meaning of those terms and change social attitudes."

But these examples are apples to oranges as to the R word. Those other "racist" or offensive words are not necessarily the language of genocide.

Would the ACLU advocate for free speech protection for a trademarked term that casts light on the mass murder of Jews at Auschwitz? Or that includes the N word vis-a-vis the massacre of Africans during American slave trade? Or that plays on sexual mutilation of Rwandan women? I would hope not.

Second, who are the ACLU lawyers who authored the brief to say that the R word is simply "racist" and thus to ignore that language as genocidal? On the topic of the R word, brother Gyasi Ross rightly observes:

This is about us speaking for us—there are too many non-Natives trying to tell us what we should or should not be offended by.

Did those lawyers even bother to consult with any Natives before taking it upon themselves to advocate for tolerable racism against America's indigenous peoples, under guise of free speech? We presume not, knowing for certain that they did not bother to even consult with NCAI before filing the brief.

Shame on you, ACLU. Hopefully the next time you attempt to speak for any historically disparaged, massacred group, you will honor morality over legality.

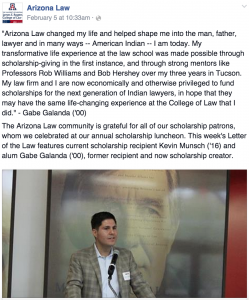

Gabriel “Gabe” Galanda is the Managing Partner at Galanda Broadman. He is a citizen of the Round Valley Indian Tribes. Gabe can be reached at 206.300.7801 or gabe@galandabroadman.com.